How Much More will the Imperialist Rivalry Heat Up? -Güneş Gümüş

Imperialism is back in popularity in the lexicon of international politics. If we were to go back not too long, twenty years ago; this word would have been identified with Marxism and therefore be declared a dirty word. Today though, it seems like there is no one that doesn’t accuse Trump of imperialism except for far-right actors. Earlier this year, the renowned liberal economics magazine The Economist described Trump as “the first imperialist president in over a century,” writing that Trump wants to combine the 19th-century idea of an “empire spying on enemies to conquer” with the powerful presidency of the 21st century (1). As if the US has just now become an imperialist country under Trump. As if imperial policies haven’t been pursued or wars all over the world haven’t been declared under Clinton-Obama era, in which the US has acted like a soft-power.

Of course, The Economist wants us to consider imperialism only as conquest and colonialism. But the issue isn’t limited to these. Colonialism was a form of imperialism at one stage, so a theory of imperialism confined solely to colonialism impairs our understanding of international politics and class struggle.

Imperialism represents a new phase of capitalism; its transformation into a dominant mode of production on a global scale by the end of the 19th century. Under these circumstances, competition of capital has shifted to a global scale with monopolization, and the protectors of capital's interests in this competition have been nation-states. In short, imperialism is itself the order shaped by the economic and geopolitical competition between nation-states for the benefit of capital. This competition can operate through the prominence of soft power based on political hegemony, as well as through the deterrent effect of weapons. The form imperialist competition takes will be determined by factors such as the international conjuncture, capitalist crisis conditions, and the dependencies created by international monopoly competition. The principle of both domestic and international policy is the same: if you have hegemonic capacity, you become a soft power. If things are going bad for you, you rely more on the stick.

“Era of Monsters”

Italian revolutionary theorist Gramsci said in 1929, "The old world is dying, the new one is struggling to be born. Now is the era of monsters.". This holds today. Following the 2008 crisis, the international order, based on the institutions and rules established under US leadership after World War II, was shaken. Neoliberal policies could no longer end the crisis of capital’s profit. While the US remains the world's largest imperialist power, China accelerated after 2008, becoming the champion of global industrial production and international trade. Under the opposing pressures from different imperialist poles, world politics wasn't always shaped as the US desired. Times when contradictions heighten nationally and internationally, when these contradictions fuel tensions, when the share of brute force is even larger…

Looking back today, it's difficult for many to imagine how two world wars unfolded, how fascism came to power. Many ask how such a spiral out of control could have happened. Look at today's world, and you can understand how the path to surprising extraordinary regimes and world wars was paved. The first extraordinary move against the established international order came from Russia, which invaded Ukraine and set its sights on seizing that country's capital. Israel followed suit. Now we're talking about whether the US will annex this or that territory. Before the 2008 crisis, if anyone had said that the US would be led by a president who hinted at seizing Canada and Greenland by deploying troops to them, everyone would have laughed. But this is what we're going through now. While Trump's outrageous outbursts may resemble the tactics of a merchant seeking to increase his bargaining power in international politics, let's not forget that bullying has become normalized in international relations. As the saying goes, whoever sows the wind reaps the whirlwind. Today, trade wars and protectionist measures are also toughening up world politics.

A New Era with Trump?

Trump's second term is being considered the beginning of a new era for the global economy and politics. The claim that we are entering a new era is based on two significant changes: first, the pulverization of the established post-World War II world order; second, the rise of protectionism through tariffs and the global impact of efforts to re-establish the US as an industrial power. If Trump succeeds in implementing these two changes, we can truly talk about a new era for the international economy and politics.

The disruption in the rules and institutions-based world order didn't begin with Trump, but he certainly accelerated its disintegration. Trump's frenzy gains support from also within the US ruling class. Trump isn't just harsh on his enemies; the same bullying style has also been directed at US's allies as well. An international policy based on US securing the largest international concessions, driven by an intimidation with the message: “cross me and you’ll pay the price”. This approach has a more immediate impact on weaker states. Panama, wary of Trump's outbursts on the Panama Canal, withdrew from China's Belt and Road project. The “iron hand in velvet glove” operation against Zelensky appears to have brought US success in the mining concessions deal for Ukraine’s rare earths. But these harsh outbursts can create the groundwork for rivalry between friends and the emergence of other alliances. On this basis, we see The Economist attempting to convince the US ruling class that Trump’s international policies will harm the US: “Feeling betrayed, allies in Europe and beyond will turn to each other for security. If chaos spreads, America will be forced to deal with new threats with even fewer tools: imagine a nuclear arms race in Asia in a system with weaker American alliances and weaker or deteriorated arms control. In a perilous time, friends, reliability, and rules are more valuable than quick buck. Congress, financial markets, or the voters could persuade Trump to back down.” (2)

An environment in which Trump declaring himself boss of the world to both his former friends and enemies, is fracturing the Western bloc as well. Amidst these crackling sounds, Trump is presenting us with new surprises. Rapprochement with Russia is one of them. In the Cold War climate of the 1970s, the US got Mao and China close to them against the Soviets; now, they're exploring whether they can build rapprochement with Russia against China. As Lord Palmerston, the 19th-century British Prime Minister, said, "England has no permanent friends or enemies; it has immutable interests". This saying, as seen, can be applied to the foreign policy of all countries around the world.

The new international game plan for the US, led by Trump, is to improve relations with Russia and sever it from the alliance with China. In fact, the main course of US imperialist policy remains the same as in the recent past: To isolate the rising threat of China, hinder its progress, and if that's not possible, slow it down. Trump is shifting tactics, not strategy. Before us is a US foreign policy that has abandoned spending and making concessions to gain the support of its Western friends, whose powers are increasingly diminished by the competition with China and whose effectiveness as allies has thus become questionable. The West needs us anyway; instead of being a burden to us, they should pay for our protection and become a source of income for us, says Trump.

Let's make a footnote and point out that the US has profited handsomely from its position at the top of imperialism for decades. If you're going to be the overlord of imperialism, military and political superiority alone isn't enough; you also need to be miles ahead of your rivals in terms of economic power. This economic superiority propels a country toward the pinnacle of imperialism; that top position, in turn, expands that country's economic power. Consider the advantages of the dollar being the reserve currency. Because the dollar is a globally accumulative currency, the US was able to weather the 2008 crisis without experiencing a major collapse. US Federal Reserve has printed trillions of dollars, saving dead companies from bankruptcy for extended periods without a surge in inflation. US capital, borrowing at low interest rates, has become a partner in the surplus value generated by production in many parts of the world by lending. Or, even though the US has been running a large current account deficit for years, it has been able to get countries that sell its products to lend them money back by investing their earnings in US Treasury bonds. The US's economic advantages are countless. Of course, just because its European friends don't pay directly doesn't mean the US doesn't gain significant economic advantages from being at the top of the imperialist system. But Trump wants more, and the US economy needs more.

Trump's shift to a sharper and more drastic foreign policy today stems from the US's economic decline vis-à-vis China following the 2008 crisis. Since Obama's presidency, the US's international strategy has been based on focusing on Asia and surrounding China. However, conventional foreign policy methods don’t produce the desired results. While the US's global economic capacity is declining, China's leaps and bounds are now sounding alarm bells for the US. For many years, China was like the world's factory floor. China's large population of cheap labor, working for international corporations, wasn't seen as a threat to the US. However, things are changing. China's economic development isn't limited to contract manufacturing or assembly. This development, which began with the technological imitation of products shipped to the country for low-cost production, continues today with China's rise to the top in many capital-intensive sectors. These signs of China's future growth, coupled with its Belt and Road project and its extensive international influence through loans to countries in need, further strengthen the perception of threat within the US. The US's slow-paced containment policy has alarmed China, hastening its attempts to develop and increase international influence. The result has been a stronger China. A segment of the US ruling class is thinking, "Let's unleash extraordinary methods". Trump is a political figure who reflects this trend.

The Trump era won't just be a time of new tactics and toughening in international politics. We're seeing a rise in the idea of returning to industrialization domestically, under Trump's leadership, to make the US economy the largest it can be once again. The tariff hike is presented as the first step in this plan. By increasing the price of imports from abroad, domestic companies are forced to produce semi-finished/finished goods domestically, and international companies are forced/encouraged to invest and produce in the US to avoid tariffs. Trump is promoting the re-industrialization of the US. However, reversing a trend established internationally since the 1970s is both difficult and costly. As a global world market was created during the neoliberal era, a global division of labor emerged between countries. Neoliberalism is based on the fragmentation of production. As a result of this fragmentation, labor-intensive production shifted to Southeast Asian countries, which had become the world's workshops, while the West, where companies' headquarters were located, became the primary beneficiaries of the profits. During this period, the West deindustrialized and transformed into economies dominated by the financial and service sectors. With the exceptions of Germany and Japan, the lucrative profits of all developed Western countries and the US were based on their superior production technologies, capital-intensive production based on these technologies, and the enormous profits generated by the financial sector. While unrivaled in capital-intensive sectors, the situation couldn’t be any better. However, as China developed its production technologies and become a strong competitor in capital-intensive sectors, achieving lucrative profits with high margins has become increasingly difficult.

Is it possible for the US to achieve industrial growth through tariff increases? Considering the many countervailing factors, this is difficult! Even if increasing tariffs forced US capitalists to produce steel, aluminum, or other products, this production would be highly expensive. It's impossible to produce goods at the same cost in the US as those produced abroad with cheap labor. Production in the US will result in products that must be sold at higher prices; this will lead to a chain reaction of rising prices for many commodities and services. Tariffs will also raise the prices of cheaply imported food in the US, leading to higher prices for consumer goods. In this situation, the public will either adapt to impoverishment or put out pressure to increase wages. All these factors will increase inflation, and may trigger the struggle among workers whose living conditions have deteriorated. The US didn't experience what Schumpeter described as creative destruction during the 2008 crisis. Bankrupt companies weren't forced into bankruptcy, unemployment didn't spread, and anger toward the system didn't grow uncontrollably. The effects of the crisis were spread over time, with the US Federal Reserve printing money to revitalize dying companies. However, if Trump implements his reindustrialization policy, he could be the cause of a devastation that will profoundly impact the public.

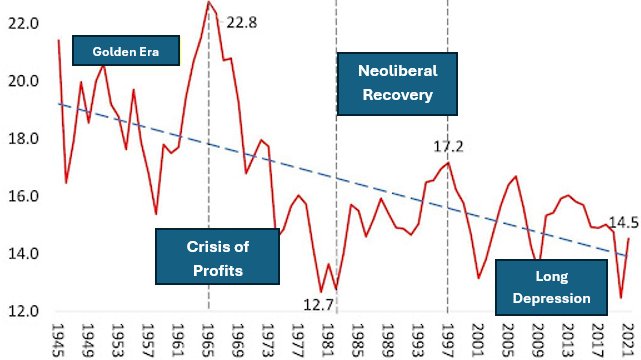

Let's assume that the negative economic effects of reindustrialization are eliminated by the state. The real question is, is it possible to achieve the desired outcome through industrialization—making the US great again? The main obstacle to industrialization making the desired contribution to the US economy is the long-standing decline in profitability in the manufacturing sector. First of all, while capitalism's profitability crisis remains unresolved, it is not easy to persuade capitalists to shoulder the risks and burdens of industrial production. Especially since the door to large profits from interest is still open. The way to reverse this trend is not through more investment or government incentives. If it were that simple, the decline in capital profitability and the resulting capitalist crises would not be an inevitable part of the system. Although neoliberal policies brought about a partial recovery in industrial profit rates after the crisis period of the 1970s, a decline occurred again in the 2000s (3):

|

Long Depression |

|

Crisis of Profits |

|

Golden Era |

|

Neoliberal Recovery |

US Non-Financial Sector Capital Return Rate (%)

Neoliberalism's solution to the profitability crisis of the 1970s was the fragmentation of production and the withdrawal of developed countries from manufacturing. Beginning in the late 1970s, the entry of China and the Eastern Bloc into the global market, coupled with the rise in labor productivity provided by computer technologies and the new branches of commodity production they offered, were highly effective in overcoming this crisis. However, the impetus provided by these influences had largely faded by the 2000s, and Western economies focused on profit-making through the financial sector. In the US, the share of financial profits in all corporate profits was around 5% in the 1940s, but by 2020, this ratio had surpassed 20% (4). While productivity has declined in the developed economies of the West and the profitability of industrial investments remains low, it seems unlikely that US capital will engage in industrialization efforts or achieve the desired results from these efforts. While labor productivity grew at a strong 3.3% between 1949 and 1973, the heyday of the US economy, it fell to 0.5% in the 2011-2014 period (5).

The US's economic growth, which fell below 2% between 1950 and 1970, is not the result of capital's behavioral deterioration, which has shifted from the burdens of industry to the lucrative profits of the financial sector. This result stems from the stagnation of labor productivity growth, which in turn stagnates profitability in manufacturing. Low labor productivity also means low capital profitability. Under these circumstances, no amount of pressure or incentives can attract capital toward industrialization, nor can one achieve economic growth through industrialization.

How Strong of a Rival is China?

In 2010, China surpassed the US to become the world's leading industrial producer. While this level is based on years of accumulated experience, a surge has certainly occurred following the 2008 crisis. The US spearheaded China's integration into the global market in the 1970s. This rapprochement, which began with the Shanghai Communiqué under the Nixon administration in 1972, would further advance with Deng Xiaoping's ascension to power in China in 1978 and China's opening to global markets in 1979. China’s development and aligning towards the West against the Soviet Union in the Cold War was strategically in line with US’ interests. This partnership was beneficial for the global economy, US capital, and China.

By embracing neoliberal policies and integrating into the global market, China contributed to overcoming the profitability crisis of the 1970s. As the Fordist model of the previous era was abandoned and production fragmented, Southeast Asia became a center for cheap production; China gradually became a key link in the global production chain. This model weakened the Western working classes and strengthened the hegemony of the capitalist order in the long run. At the same time, China, with its large market, was creating a new area for growth in the global economy. For a significant period, China provided cheap labor, reducing production costs and enabling international capital to increase its profitability. Cheaply produced goods in China would also act as a depressing factor on global inflation. While the 1974 crisis brought about a major inflation problem, cheap products provided by China lowered the cost of living in the West, helping to control inflation. Perhaps some in the US might lament: "the China that we lent a hand towards turned out to be a threat to us", wishing they hadn't helped China's entry into the global market. But the US was amply rewarded for its support, both politically in an anti-Soviet pact and in terms of profitability.

While China's share of global trade was less than 1% in the late 1970s, this figure had risen to 12.7% in 2018. China worked primarily as a workshop for international corporations (6). Its tremendous growth was still due to low-tech production based on cheap labor. However, the 2008 crisis would be a turning point in China's economic development, leading to significant advances in production technologies.

If we are to talk about critical dates for China’s development, we should count the Mao-Nixon reconciliation in 1972, the integration into the global neoliberal market with Deng Xiaoping’s ascension to the presidency in 1978, membership in the World Trade Organization in 2001, the 2008 crisis, and the One Belt One Road project that began in 2013 as cornerstones.

China has been a clear leader in manufacturing since 2010. China's manufacturing value added to gross domestic product ratio is also significantly higher than that of Japan and the US: while this ratio was 26% in China in 2023, it was 11% for the US in 2021 and 19% for Japan in 2022 (7). China's manufacturing industry is nearly twice the size of the US. China, a leader in world trade, also accounts for a very high share of high-technology products among its exports. China accounted for 33.46% of global high-technology product exports in 2021 (8).

According to the United Nations Industrial Development Organization, China is expected to produce 45% of the world's industrial output by 2030 (9). This is an incredible rate; except for the period when the USA held industrial hegemony after the devastation of World War II, no country in modern world history has approached this level. However, the issue is not limited to China being an enormously large economy, the center of global industrial production, and the export champion. China is no longer a simple workshop producing semi-finished goods or assembling the final product for international corporations, taking advantage of its large, cheap labor population far from acting as the brain in manufacturing industry. China has made great strides in production technologies and, with many high-tech companies, is a power that rivals and sometimes surpasses the US's major technology companies known as the Magnificent Seven. In contrast to the US's major technology giants Alphabet, Amazon, Apple, Indivia, Meta, Microsoft, and Tesla; China has been able to create large-capacity companies such as Baidu, Alibaba, Lenovo/Xiaomi, Smic, and Byd. China has made significant advances in areas such as the aerospace economy, robotics/machinery, mobilization, pharmaceutical and agricultural chemistry, energy production, and artificial intelligence. China aims to become the world's largest consumer and producer of semiconductors. It has reached 7nm chip production but is still dependent on the US and Taiwan for the most advanced chips. China produces 60% of 5G base stations and has the largest 5G network in the world. China accounts for 60% of global electric vehicle (EV) production (BYD, NIO, Geely, Xpeng). Chinese automaker BYD's market capitalization has risen to $162 billion, surpassing that of Ford, General Motors, and Volkswagen combined.

China's leading battery manufacturers (CATL, BYD) account for 70% of the world's lithium-ion battery production. China is the only country competing with the US in artificial intelligence (AI) development. China has some of the world's fastest supercomputers. The China National Space Administration (CNSA) sent the Tianwen-1 rover to Mars in 2020, and taikonauts settled into their own space station in 2021. It competes with the US in hypersonic missiles and unmanned aerial vehicles.

In 2020, China led global production in 7 of 10 advanced industries, while the US led in only 3 (10):

Hamilton Index of Industry Leaders, 2020

What will determine how formidable a competitor China will be against the US is its ability to achieve high labor productivity and innovate in manufacturing technologies. If China can become an innovation peer, it can dominate the global economy. If China's existing leading technology companies make significant gains in market share, it will transform the nature of the global economy.

China owes its technological leap forward largely to the US's threatening foreign policy. Concerned that its development would be hindered by the US's containment, China has focused since 2011 on increasing its international influence and transforming into a formidable global economic power. As the US pursued protectionist policies and alliances to exclude China from global value chains, China embarked on developing self-sufficient supply chain alternatives to avoid external dependence in the event of a second Cold War.

With Xi Jinping's rise to power in 2012, a more aggressive management approach emerged in both the national economy and international relations. The Belt and Road Initiative, launched in 2013 using a massive $4 trillion foreign exchange reserve, accelerated the global expansion of Chinese capital. Major investments were made in many regions of the world, including Central Asia, Southeast Asia, Africa, Latin America, the Caucasus, and Western Europe, either within the scope of this project or not directly part of it, furthering China's international hegemony. Today, Trump's increasingly aggressive and hostile policies toward China could advance China's global economic, political, and military development to another level. Changes that mark history unfold in extraordinary times.

What Awaits the World?

Tariffs and economic protectionism don’t remain only as policies related to global trade. For many years, the US has operated with an external deficit, a situation where imports exceed exports. This means that many countries profit from exporting goods to the US. Increasing tariffs will have significant economic losses for countries ranging from China to Europe, Canada to Mexico, and will trigger similar reactions in these countries over time. When inflation in the US rises due to tariffs’ increase, the Fed will keep interest rates high, causing the dollar to appreciate. This will impact the global economy through trade and finance. This will reduce global trade volume due to higher export costs, increasing the interest rate on dollar-denominated debt. This will particularly contribute to a contraction in developing economies.

Trump's impact will not only be limited to the global economy entering a difficult period; it will also pave the way for an aggressive international policy. Already, the famous British newspaper, the Financial Times, is declaring through its editor-in-chief Martin Wolf, that "The US is now the enemy of the West... Europe will either do what is necessary or fall apart"(11). The following statement by the Chinese Foreign Ministry in response to Trump's order to increase tariffs demonstrates that the escalation will find a response, albeit a contained one: "If the US wants war, whether it's a customs war, a trade war, or any other war, we are ready to fight to the end". And we saw that China would live up to these promises through mutual tariff hikes with Trump. Of course, we won't face an immediate imperialist war. China won't choose to engage in even minor conflicts with the US before it's ready. In a world where all major actors are armed with nuclear weapons, a new world war will be much more difficult to start. However, this doesn't mean we won't be left with proxy wars and international tensions. As Chekhov said, "If there's a gun hanging on the wall in the first act, it's bound to go off in the second or third."

REFERENCES

- Economist (2025, January 23) “America has an imperial presidency”, https://www.economist.com/leaders/2025/01/23/america-has-an-imperial-presidency

- Economist (2025, February 27) “Donald Trump has begun a mafia like struggle for global power”, https://www.economist.com/leaders/2025/02/27/donald-trump-has-begun-a-mafia-like-struggle-for-global-power

- Roberts, M. (2022, December 18) “The US rate of profit in 2021”, https://thenextrecession.wordpress.com/2022/12/18/the-us-rate-of-profit-in-2021/

- Ibid.

- ECB Economic Bulletin (2016) “The slowdown in US labor productivity growth – stylized facts and economic implications”, Issue: 2, https://www.ecb.europa.eu/pub/pdf/other/eb201602_focus01.en.pdf

- Nicita, A. and Razo, C. (2021) “China: The rise of a trade titan”, https://unctad.org/news/china-rise-trade-titan

- “Hi-Tech Exports by Country (Top 96 Countries)”, https://rankingroyals.com/technology/hi-tech-exports-by-country-top-96-countries/

- UNIDO (2024), “The Future of Industrialization”, p. 17

- ITIF (2023, 13 December) “China is dominating advanced industries as US, G7 and OECD economies founder”, https://itif.org/publications/2023/12/13/china-is-dominating-advanced-industries-as-us-g7-and-oecd-economies-founder/

- Wolf, M. (2025, February 25) “The US is now the enemy of the West”, https://www.ft.com/content/b46e2e24-ca71-4269-a7ca-3344e6215ae3

![Breaking news: Reza Shahabi And Hassan Saeedi, The Imprisoned Members of The Syndicate of Workers of Tehran and Suburbs Bus Company, Were Released [Today, September 1, 2024]](https://socialistmiddleeast.com/uploads/images/image_380x226_66d58ec4962c1.jpg)