Keynesianism: A “New” Hope for Capitalism? -Güneş Gümüş

After 11 years have passed since the 2008 crisis, one of the biggest 4 crises of capitalism, we came to 2019. Decision makers of the capitalist system spent these 11 years only at the expense of creating an even bigger crisis, with financialization fights to save the day. That was the declaration of the fact that they only postponed the crisis but it clearly came to the end in 2019. It was almost everyone saying that a great crisis would break out in 2020. The only thing that was unexpected was the COVID-19 pandemic hitting the capitalist world like a big bum meteor. Thus, the dimensions of the crisis grew rapidly. The IMF, which is known for its more moderate analysis, reports a crisis that would leave the Great Depression behind and mentions that more than 300 million people worldwide will be permanently unemployed due to the coronavirus pandemic.

Nowadays, spokespersons of big monopolies, central banks, capitalist governments, and bourgeois economists and academics ponders how to get out of this crisis. Although ruling classes continue to neoliberal practices, it is no secret for anyone that this model no longer works. In the search for an alternative new capital accumulation model, the Keynesian model has become the focus of attention again. Could the Keynesian model, which was in the force in the golden age of capitalism between the World War 2 and 70's, be reintroduced today again? The current crisis brings the Keynesian model back to the agenda, focusing on the question of "how do we increase demand to perfect the functioning of the capitalist economy", especially in the environment of unemployment and global decline that has exploded with the effect of a pandemic.

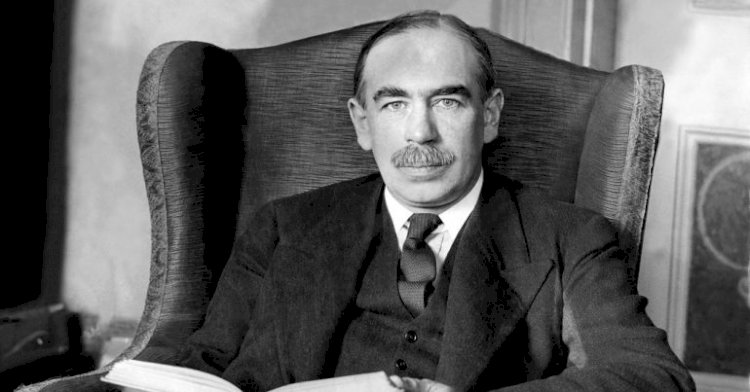

What does Keynes Suggest?

The book "The General Theory of Employment, Interest and Money", in which Keynes broadly proposes his economic model, is dated 1936 when the extraordinary conditions around the world created precisely favorable conditions for the emergence of a new capital accumulation model. The 1929 Depression, which has taken the world by storm, allows the discussion of the "laissez-faire" understanding that established its hegemony over bourgeois economics in the early periods of industrial capitalism. In this conjuncture, Keynes develops a demand-side model that will erase the effect of this understanding, which means, “the market finds the best of everything on its own” for a long time. “Laissez-faire” approach can be summarized as follows: the self-adjusting finds its equilibrium by its own and the worst thing that the governments can do is to intervene it. This is what they call "let them do".[1]

John Maynard Keynes, a member of the Liberal Party and economic adviser throughout his life, sees the problem not in capitalism but in "laissez-faire" capitalism, which is based on markets and investors without regulation. In the philosophical background of this assumption, there is the idea that individuals' pursuit of their own interests will not yield socially perfect results; because “individuals… often do not have the consciousness, knowledge and willpower needed to achieve ideal results; In other words, the individual who does not have the capacity to use the opportunities before him is in need of other tools and others in order to achieve the results of profit maximization maximize or to gain the freedom to get it. ”(Kılınçoğlu and Özçelik, 2016: 31).

For Keynes, it is inevitable for the system to become obstructed if everyone pursues their own interests without caring for the rest of the society and the contradictions created by this situation are not corrected by state intervention. For example, it may seem meaningful to decrease wages and increase profits for a single firm, but considering the overall economy and beyond time, this situation will bring a decrease in demand, as it will hinder workers' capacity to buy commodities .[2]

Keynes sees the inadequacy of spending as the cause of the recession. When it comes to insufficient expenditures, he speaks of two components of effective demand: the consumption expenditures of workers whose wages have fallen, and investors who have become pessimistic about the future after the decline in demand. Thus, the vicious circle begins: capitalists reduce the investments, as demand drops. In turn, unemployment increases and demand decreases again as purchasing power decreases.

Under the name of Marxist analysis of crisis, it is possible to find interpretations that underconsumption is responsible for the crisis. These approaches seems like in line with the economic outlook at first sight. Indeed, capital is constantly taking from laborers, and workers whose spending capacity is constantly declining are unable to consume enough. As a result, it is inevitable for the economy to go into a crisis, since only when commodities are sold, profit is realized. However, when the dynamics of capitalism are elaborated, it is seen that these interpretations are insufficient to explain the crisis. The approach of deficient demand theories to crisis theories cannot explain why crises never ends under capitalism. If the crisis is due to the weak consumption capacity of the working class, this is an indispensable fact of capitalism. The source of all surplus-value, as Marx puts it, is the unpaid labor of the worker; the value it creates is not in its own pocket, but in the bosses' safe. Therefore, as long as capitalism exists, underconsumption will continue to exist. Deficient demand analysis cannot explain why crises occur at certain historical moments - sometimes even at the peak of consumption. For example, the 2008 crisis is the product of a period when loan usage peaked for the purchase of housing:

"It is sheer tautology to say that crises are caused by the scarcity of effective consumption, or of effective consumers… But if one were to attempt to give this tautology the semblance of a profounder justification by saying that the working-class receives too small a portion of its own product and the evil would be remedied as soon as it receives a larger share of it and its wages increase in consequence, one could only remark that crises are always prepared by precisely a period in which wages rise generally and the working-class actually gets a larger share of that part of the annual product which is intended for consumption."[3]

"The under-consumption of the masses is a necessary condition of all forms of society based on exploitation, consequently also of the capitalist form; but it is the capitalist form of production which first gives rise to crises. The under-consumption of the masses is therefore also a prerequisite condition of crises, and plays in them a role which has long been recognised. But it tells us just as little why crises exist today as why they did not exist before."[4]

Marx argues that behind the capitalist crisis is the downward profitability trend. The cause of the crises is not lack of consumption, but profitability. Capitalists in competition, allocates increasingly so much money for investment expenditures that the amount of profit (rate of profit) obtained, in comparison to the money put as capital, tends to decrease. Even if this decline is tried to be prevented by continuous efforts, when this situation becomes unsustainable, production turns into a meaningless activity for the capitalists. The waves of crisis hit every sector.

How to Create Demand?

According to Keynes, the Depression of 1929 created a vicious circle that could not be easily overcame without state intervention; high unemployment, reduction in effective demand, decrease in business volume and increasing unemployment again. Keynes' proposals to break this vicious cycle are full employment policies of governments, investment spending to establish public enterprises, and implementation of fiscal policies to prevent income injustice to increase consumption. According to Keynes, the source of the expenditures required by state intervention should be provided from public borrowing, rather than taxes that would reduce private spending.

One of the pillars of the Keynesian model is income distribution and fiscal policies that will regulate public spending. These policies are based on the taxation of the rich for income justice and the building of the welfare state with the resources obtained. For example, the tax rate received from the highest income group in the 1940s was 91% and similar tax rates were valid in Europe. As a result, the low-income group spends a much larger portion of its income; when the income of this segment rises, the total demand increases. ”As the income of individuals increases, their consumption increases too, but the rate of increase in consumption remains below the rate of increase in income. In other words, individuals spend less and less of their income on consumption as their income increases… Spending an increasingly lower part of income on consumption causes insufficient demand and therefore prices and profitability levels to decrease” (Kılınçoğlu ve Özçelik, 2016: 129). Keynes argues that a fairer distribution of income serves to grow capital by increasing consumption spending.

According to Keynes, the biggest economic mistake of the society we live in is the failure to provide full employment, arbitrariness and extreme inequality in wealth and income distribution. Lack of full employment is also an obstacle to the growth of capital. Keynes suggests that the private enterprise's failure to provide full employment should be compensated by the state's fiscal and monetary policies. The main goal of the Keynesian model's monetary policy is to promote investment. For Keynes, the way to encourage investments is to keep interest rates low and to overcome the inadequate consumption expenditures that cause bosses to be pessimistic about the future. Low interest rates will be an important incentive to capital that will use credit for investment .[5]

Without A Break from Capitalism

While Keynes argues that the market should not be left on its own, it does not go beyond a liberal economic model but he does not suggests a general intervention and regulation that would eliminate private enterprise. Keynes, who is a clear opponent of the October Revolution, Bolshevism and socialism, always takes the side of the capital.

"Ought I, then, to join the Labour Party? Superficially that is more attractive. But looked at closer, there are great difficulties. To begin with, it is a class party, and the class is not my class. If I am going to pursue sectional interests at all, I shall pursue my own… the Class war will find me on the side of the educated bourgeoisie" (Keynes, 1963).

There is a clear distinction between productive industrial capital and speculative financial capital for Keynes. In this book of General Theory, Keynes sees the demand for money for speculative purposes as one of the most important reasons of the economic crisis:

"Now, we have been accustomed in explaining the “crisis” to lay stress on the rising tendency of the rate of interest under the influence of the increased demand for money both for trade and speculative purposes" (Keynes, 2010: 269).

Speculators are harmless as bubbles on a steady stream of enterprise. But the position is serious when the enterprise becomes a bubble on a whirlpool of speculation. When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.(Keynes, 2010: 142).

Keynes, who thinks that in order to eliminate the rent that he sees as a “'functioneless investor", with the help of high taxes, low interest rates and tight government control over the financial system, claims that the disposal of the rentier will serve to increase investment and full employment as it will prevent the speculative use of money:

"If the rentier is less prone to spend than the entrepreneur, the gradual withdrawal of real income from the former will mean that full employment will be reached with a smaller increase in the quantity of money and a smaller reduction in the rate of interest than will be the case if the opposite hypothesis holds." (Keynes, 2010: 250)

When capitalism falls into trouble, many bourgeois ideologists tend to attribute the responsibility of economic or social crises to the various elements of it, not to the system. There are many who consider financial capital, like Keynes, the roots of the evilness. For example, Kautsky described imperialism as a product of the pro-war attitude of speculative financial capital. As a result, it is easy to declare financial capital, which enjoys the profit of high interest rates instead without any production and job creation.

But this approach reveals that the operation of capitalism is not understood. Marx revealed the link between the financial sector and production and he elaborated the relationship between the increase in the organic composition of capital and increased financialization. The distinction between good industrial capital and bad financial capital is artificial. While these two factors are intertwined, the increasing financialization is not a deviation from the "perfect" capitalist economy, but the profit rates correspond to the greed for higher profit rates to compensate for this decline:

"If the rate of profit falls... there appears swindling and a general promotion of swindling by recourse to frenzied ventures with new methods of production, new investments of capital, new adventures, all for the sake of securing a shred of extra profit which is independent of the general average and rises above it."[6]

The increasing weight of the financial sector indicates the decay of capitalism. The aging capitalist system is no longer able to reach old growth rates, profitability levels, and under these circumstances, rather than enduring the hassle of production, they seek to find productive capitalists in each corner of the global order, where they can offer their savings with high interest rates, and prefer to leak some share from their surplus-value.

Has the Keynesian Model Succeeded?

The Keynesian model came to the end with a crisis have not seen before, that was the combination of high inflation, increased unemployment and low growth, and became out-dated for the ruling classes in 70's. Under the conditions of the economic crisis in the 1970s, capitalism was in need of a new capital accumulation model that gave rise to neoliberalism. Of course, behind the failure of capitalism is not this or that economic model; it is the capitalist dynamics itself. The capitalist system cannot, by definition, overcome crises that are internal to itself due to the downward trend in profit rates with a "miraculous" economic model. On the contrary, while the time spent in the crisis is getting longer, the time period between crises gets shorter.

So how could Keynes' demand sided model create brilliant days from the Second World War to the 1970s? In fact, let us state that the “golden age” of capitalism is not directly a product of Keynesian policies. In order for capitalism to get out of the economic crisis, the rate of profit had to restore its downward trend. That period was one of the most favorable periods for this restoration. After the World War II, a whole Europe was destroyed, and after the war a rebuilding process started with the support of the USA. After the war, labor cost was very cheap; hence the exploitation rate had increased. Employment rates reached nearly one hundred percent, and the consumption of workers, whose income rose after the war, increased too. In the same period, the decolonization of the Third World was experienced, in these countries and the process of partial industrialization offered important opportunities for capital. The Cold War era between Western Europe-the USA and the Eastern Bloc triggered military spending; the armament economy helped economic growth.

During the period of war preparations and wars since the First World War, states had already started to control economic and social resources. Capital could not bear the cost of restoring Europe, which remained under the ruins after the war. State intervention became the savior of capitalism. While economy was growing and the profit rates increasing, it was beneficial for the states to keep the unprofitable sectors alive. But when the downward trend in profit rates increased, it was an imperative that the capital loot public resources and restore its profitability, making every single field a part of commodity production. Privatization, monetarism, deregulation were no more than attempts to limit the decline in profits against the working class.

Thus the 40-year old neoliberal period started. Neoliberalism proved that the idea that contradiction between labor and capital is compromise, and capital can give up stealing more than the laborer (seizing more of the value it produces)is just a Keynesian illusion. Now, Milton Friedman, one of the leading ideologists of neoliberalism, rejects Keynesian full employment target against stagflation claiming that inflation increased because of the unemployment rate pulled below the "natural" rate by governments. Of course, neoliberals want public resources to be used to save capital in crisis, not to create full employment. On the other hand, they know that army of the unemployed meant a working class that must agree to work for lower wages, worse conditions and less rights.

Is Keynes the solution?

When it is needed, neoliberalism used various economic policies of the Keynesian model. For example, Alan Greenspan, who is the President of the FED in the expansion period, or Ben Bernanke, his counterpart in financial crisis period, decreased interest rates. The result of the easy and inexpensive money that the Central Bank pumped into the market was the creation of a big bubble in the mortgage market. Another Keynesian practice is that governments loaned huge amount of money in the past 20 years. Today, after the coronavirus pandemic, central banks have gave generous credits to save the companies. During the coronavirus pandemic, the rulers even transferred money (helicopter money) directly to their citizens. The rulers around the world have robbed the state treasures to get of the swamp of the economic crisis that made debts to be transferred to the next long years. Borrowing is not limited to the state as in Keynes period. Private companies' debts are rising higher than ever. The financial sector, which is at the center of these debts and whose share in the world economy has increased incredibly, is almost impossible to be controlled and financially regulated as Keynesianism asserts.

There was no change in the need for mass consumption under neoliberalism. But today, the source of consumption capacity is the workers, who once less taxed, supported by welfare state practices, and earned better wages under strong unions, now mortgage their future incomes rather than their relatively high disposable income. Although there is a change in the capital accumulation model, a significant portion of the workers will spend their long years to pay their debt.

More importantly, the Keynesian model aimed at the intervention of the state in the reconstruction of a collapsed Europe. Now, even if the Treasuries, which are already in debt, rescue their companies like Renault, which has weaken by the crisis due to the coronavirus pandemic after the 2008 crisis, and run them by themselves, it seems that they have not the opportunity to create a change in the organic composition of the capital or the rate of profit. What will the states invest in? When the state invests, how can they ensure that the products of the national capital are consumed by the national consumers when the globalization peaks?

Crisis periods make protectionist tendencies raise. The crisis means the imperialist rivalry between countries to keep their capital alive that we see more conflict rhetoric and conflicts around the world among the leading imperialists. This situation opens the door to new wars. Without a new world war and global destruction, the conditions for an investment mobilization that will raise the profit rates in terms of capital will not occur.

In short, the implementation of the Keynesian model has no ground. It is not because the Keynesian model is too progressive or pro-worker. When the the world economy is over-debted, domination of the financial capital in the world economy increased, the globalization peaked, imperialist powers are ready to embrace each other, there is no hope for the recovery of profit rates; the full employment, income justice, financial regulation and welfare state that constitutes Keynesianism is a dream.

The masters of capitalism do not even have the recipe out of crisis - a new capital accumulation model. Therefore, they continue to postpone the crisis by burderning it on the back of the laborer until the laborers say enough.

References

Engels, F. (2003), Anti-Dühring

Keynes, J. M. (1963) Essays in Persuasion, WW: Norton&Company.

Keynes, J. M. (2010) İstihdam, Faiz ve Paranın Genel Teorisi, İstanbul: Kalkedon.

Kılınçoğlu, D.T. ve Özçelik, E. (2016) John Maynard Keynes… Yine Yeniden, İstanbul: İletişim.

Marx, K. (1997) Kapital Volume III

Marx, K. (2003), Kapital Volume II

[1] It should not be forgotten that the liberal and neo-liberal ideologists, free market defenders, supported the state to save the companies in the face of deep crises. Opposing state intervention does not involve transferring money from public resources to capital. It is opposed to the regulation of labor relations in favor of the laborers. With the motive of maximizing the profit, they make the propaganda to transfer large public resources to the capital and leave the production to private capital in profitable sectors.

[2] Keynes perceives the economy as a social issue, different from an individual interplay of actors, and advocates the state intervention in unemployment, investment and consumption for its excellent functioning.

[3] Marx, Capital Vol. III Part III, The Law of the Tendency of the Rate of Profit to Fall, https://www.marxists.org/archive/marx/works/1885-c2/ch20_01.htm

[4] Engels, Anti-Dühring, https://www.marxist.com/classics-anti-duehring/3.-production.htm

[5] Despite the low credit rates in Japan for more than 20 years, there is no desire to invest in the capital since the production sector uses excess capacity. The result of this long-standing monetary policy of Japan has been a stagnation that cannot be resolved.

[6] Marx, Capital Vol. III Part III, The Law of the Tendency of the Rate of Profit to Fall, Chapter 15. Exposition of the Internal Contradictions of the Law https://www.marxists.org/archive/marx/works/1894-c3/ch15.htm